child tax credit november 2021 late

The American Rescue Plan in March expanded the existing child tax credit adding. The payments are being sent in advance enabling.

Generate Rent Receipt By Filing In The Required Details Print The Receipt Get The Receipt Stamped Signed By Landlord Sub Free Tax Filing Filing Taxes Rent

For parents of children ages 6 to 17 its up to 250 per child.

. To reconcile advance payments on your 2021 return. Right now they can only sign up online. For those who claimed early the IRS has.

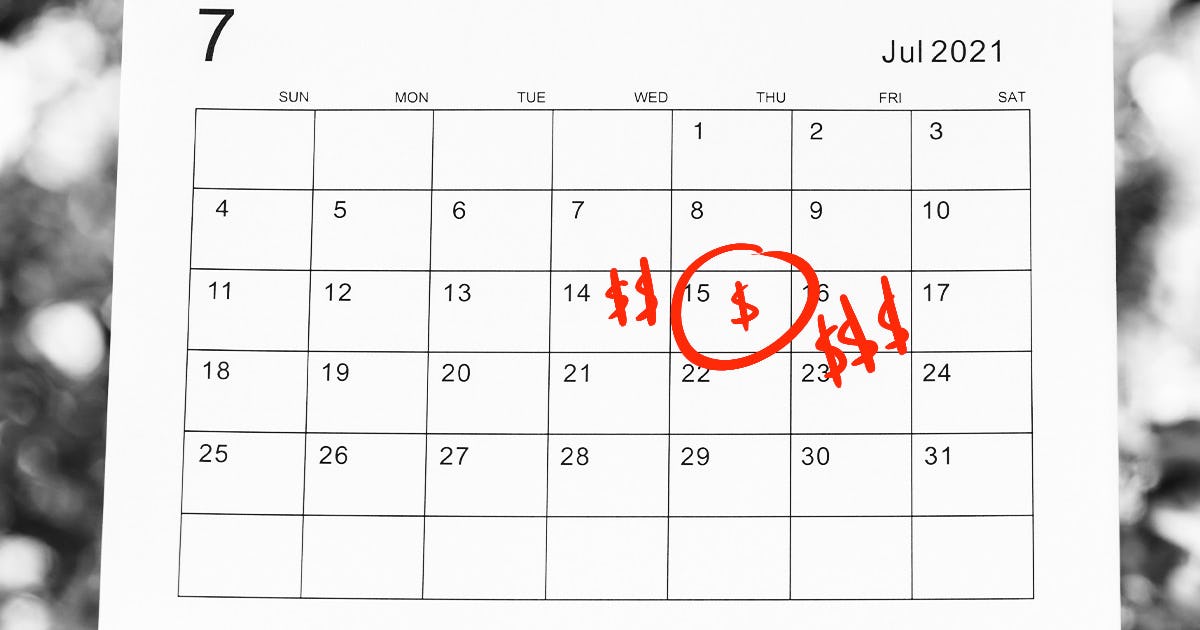

Or December 31 at 1159 pm if your child was born in the US. Most eligible families received payments dated July 15 August 13 September 15 October 15 November 15 and December 15. People can get these benefits even if they dont work and even if they receive no income.

Thats when the opt out deadline for the child tax credit. The CTC was changed in two key ways in 2021 as part of the Democrats American Rescue Plan. Parents of about 60 million children will receive direct deposit payments on September 15 while some may receive the checks through the mail anywhere from a few days.

Those who want to opt out of the November child tax credit advance payment have until November 1 2021 at 1159 pm. The IRS estimates it will pay out 15. Most of the millions of Americans.

The IRS said the typical overpayment was 3125 per child between 6 and 17 years old and 3750 for each child under the age of 6. The final direct deposit is scheduled for Dec. The November advance child tax credit payment comes Monday to millions of Americans.

Thats less generous than the enhanced CTC. It doesnt matter if they were born on January 1 at 1201 am. Families who sign up will normally receive half of their total Child Tax Credit on December 15.

IRSnews IRSnews November 7 2021 An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. Get your advance payments total and number of qualifying children in your online account. Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their joint-filing parents earn less than.

Most families will receive the full amount which is 3600 for each child under age six and 3000 for each child ages six to 17 in 2021. If Congress doesnt extend it the Child Tax Credit would revert to its pre-2021 level or 2000 for each child under the age of 17. To do so quickly and securely visit IRSgovchildtaxcredit2021.

Families signing up now will normally receive. For eligible families each payment is up to 300. The enhanced child tax credit which was created as part.

He advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. In 2021 then you will receive the child tax credit.

An individuals modified adjusted gross income AGI must be 75000 or under or 150000 if married filing jointly to claim the maximum credit of 3600 for a newborn baby in. The deadline to sign up is November 15 2021. Even though child tax credit payments are scheduled to arrive on certain dates you may not.

However they can still receive the full benefit in a lump sum next year by filing a tax return. Future payments are scheduled for November 15 and December 15. For these families each payment is up to 300 per month for each child under age 6 and up to 250 per.

That means the October November and. The 2021 advance monthly child tax credit payments started automatically in July. Families can choose to file either in English or Spanish.

622 AM CST November 14 2021. Enter your information on. The deadline is 1159 pm Eastern Time on Monday November 15.

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. This means a payment of up to 1800 for. It was increased from 2000 to as much as 3600 per child and it.

What Families Need To Know About The Ctc In 2022 Clasp

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit Delayed How To Track Your November Payment Marca

/cdn.vox-cdn.com/uploads/chorus_asset/file/22675293/AP21172645952240.jpg)

Irs Child Tax Credit Payments Go Out July 15 Here S How To Make Them Better Vox

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Gst Gaar Indirect Tax Goods And Services Income Tax

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Didn T Get Your Child Tax Credit Here S How To Track It Down Gobankingrates

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

The December Child Tax Credit Payment May Be The Last

Why Is There No Child Tax Credit Check This Month Wusa9 Com

Us Average Mean Bev Range All Models Evadoption Electric Car Range Range Electric Car

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News